See This Report about Mileagewise - Reconstructing Mileage Logs

Wiki Article

The Only Guide for Mileagewise - Reconstructing Mileage Logs

Table of ContentsGetting The Mileagewise - Reconstructing Mileage Logs To WorkGetting My Mileagewise - Reconstructing Mileage Logs To WorkHow Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.Some Known Facts About Mileagewise - Reconstructing Mileage Logs.Not known Details About Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs Fundamentals ExplainedEverything about Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Distance attribute suggests the fastest driving course to your staff members' location. This feature improves efficiency and adds to cost financial savings, making it an essential possession for organizations with a mobile workforce. Timeero's Suggested Course function better increases liability and efficiency. Staff members can compare the recommended course with the actual path taken.Such an approach to reporting and compliance simplifies the typically complicated job of taking care of gas mileage expenses. There are many benefits connected with utilizing Timeero to keep track of mileage.

A Biased View of Mileagewise - Reconstructing Mileage Logs

These added verification procedures will maintain the IRS from having a reason to object your gas mileage records. With accurate gas mileage monitoring modern technology, your employees do not have to make harsh mileage price quotes or even stress regarding gas mileage cost tracking.

For instance, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all vehicle expenses. You will certainly require to proceed tracking mileage for work also if you're utilizing the actual expenditure approach. Keeping gas mileage records is the only means to separate company and individual miles and provide the proof to the internal revenue service

The majority of mileage trackers allow you log your journeys by hand while computing the range and reimbursement amounts for you. Many also included real-time trip monitoring - you require to start the app at the beginning of your journey and quit it when you reach your last location. These applications log your begin and end addresses, and time stamps, in addition to the complete range and compensation quantity.

The Mileagewise - Reconstructing Mileage Logs Statements

One of the questions that The INTERNAL REVENUE SERVICE states that automobile expenses can be considered as an "regular and needed" expense in the program of working. This includes costs such as gas, maintenance, insurance coverage, and the car's depreciation. However, for these costs to be taken into consideration deductible, the lorry ought to be utilized for service purposes.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

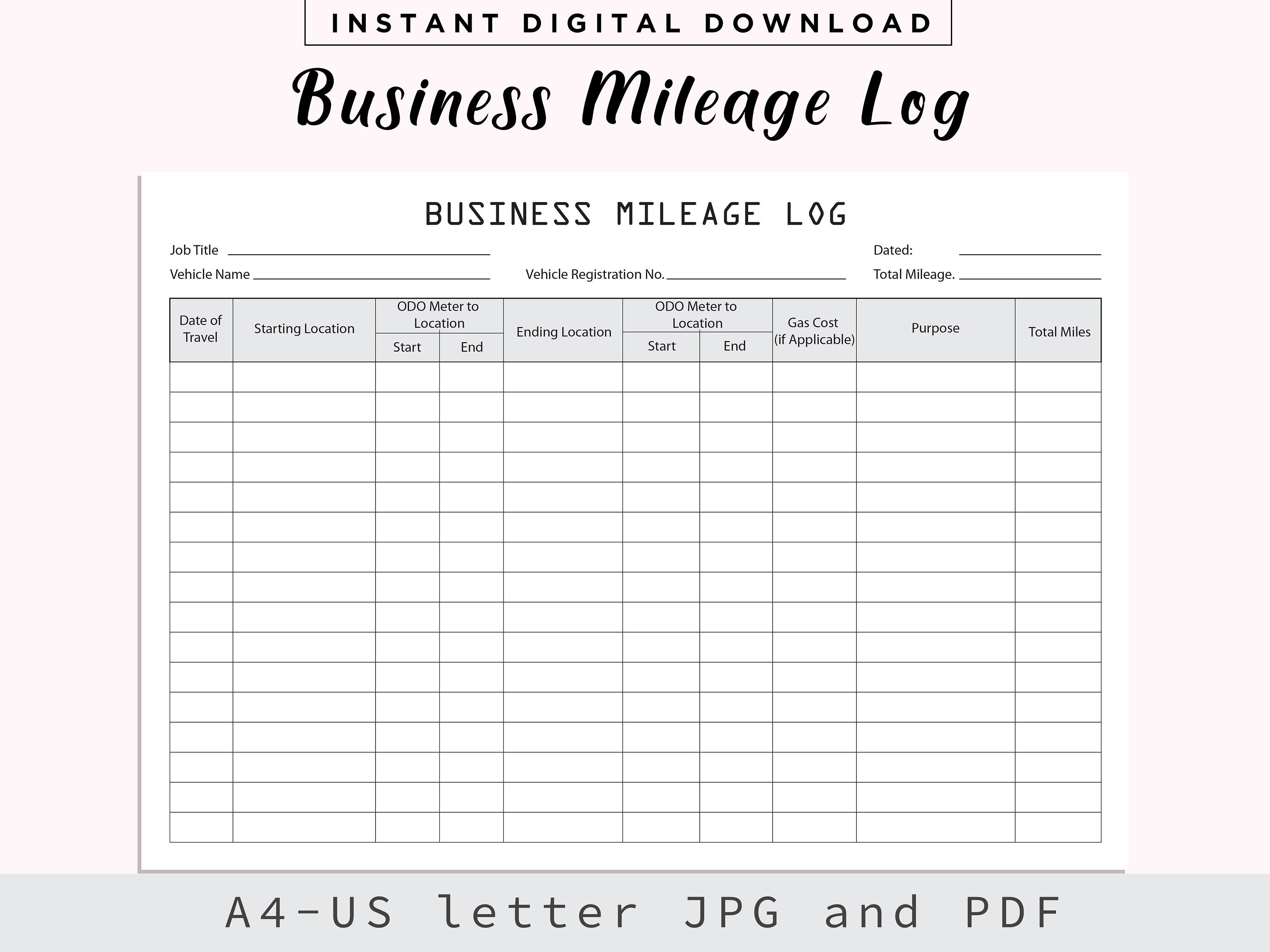

In between, diligently track all your organization trips keeping in mind down the starting and finishing analyses. For each journey, document the place and organization function.This consists of the complete company gas mileage and complete gas mileage accumulation for the year (service + personal), trip's day, location, and objective. It's important to videotape activities promptly and keep a coeval driving log detailing date, miles driven, and organization purpose. Here's exactly how you can enhance record-keeping for audit purposes: Begin with making certain a thorough mileage log for all business-related travel.

Things about Mileagewise - Reconstructing Mileage Logs

The real expenses technique is a different to the common mileage rate approach. Rather than determining your deduction based on an established rate per mile, the actual expenditures approach permits you to subtract the real costs connected with utilizing your car for business functions - best free mileage tracker app. These costs include gas, upkeep, repair services, insurance policy, depreciation, and other important link related expensesThose with considerable vehicle-related costs or distinct problems may benefit from the real expenses approach. Please note choosing S-corp status can transform this estimation. Eventually, your picked technique ought to straighten with your certain monetary objectives and tax situation. The Criterion Gas Mileage Rate is a procedure issued annually by the IRS to determine the insurance deductible expenses of running a car for company.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

(https://telegra.ph/The-Ultimate-Guide-to-the-Best-Mileage-Tracker-App-for-Taxes-11-21)Whenever you use your car for business trips, tape-record the miles traveled. At the end of the year, once more write the odometer reading. Calculate your total business miles by utilizing your beginning and end odometer analyses, and your taped company miles. Precisely tracking your exact gas mileage for service trips aids in validating your tax reduction, particularly if you choose the Criterion Gas mileage technique.

Keeping an eye on your mileage by hand can require diligence, however keep in mind, it could conserve you money on your taxes. Follow these steps: List the date of each drive. Record the complete mileage driven. Think about noting your odometer readings prior to and after each trip. Write down the beginning and ending factors for your journey.

Mileagewise - Reconstructing Mileage Logs - Questions

And currently virtually every person utilizes General practitioners to obtain about. That indicates virtually every person can be tracked as they go about their company.Report this wiki page